The tools you find in North America and Europe differ significantly due to market preferences, distribution strategies, and product design priorities. North American brands like DeWalt, Milwaukee, and Craftsman focus on durability and accessibility, catering to both professionals and DIYers. European brands like Bosch, Festool, and Knipex prioritize precision and specialization, often targeting niche markets with higher price points.

Key differences include:

- North America: Tools are widely available in big-box stores (e.g., Home Depot, Lowe’s) and online. Products often emphasize versatility, affordability, and durability.

- Europe: Tools are sold through specialty stores and authorized dealers. They emphasize precision, specialized features, and premium quality.

Quick Comparison

| Feature | North America | Europe |

|---|---|---|

| Top Brands | DeWalt, Milwaukee, Craftsman | Bosch, Festool, Knipex |

| Retail Presence | Big-box stores, mass availability | Specialty shops, controlled sales |

| Price Range | $10–$300 | €20–€300+ |

| Focus | Durability, broad appeal | Precision, specialization |

| Measurement Units | Imperial (inches, pounds) | Metric (millimeters, kilograms) |

Navigating these differences can be challenging, especially when managing tools across regions. Platforms like Toolstash simplify this by organizing tools, tracking specs, and addressing compatibility issues (e.g., voltage or measurement systems).

Top 20 Power Tool Brands Ranked for USA Support!

Tool Brands in North America

North America is home to many tool brands, made for both weekend DIY fans and pros who use heavy tools. This wide mix shows how big and active the tool market is and who leads it.

Top North American Brands

Stanley Black & Decker, a big name in the field, made more than $15 billion in 2022. It owns brands like DeWalt (known for strong power tools), Craftsman (trusted hand tools), Black & Decker, Stanley, Bostitch, Irwin Tools, Lenox, and Porter-Cable\ [4].

Milwaukee Tool, under Hong Kong's Techtronic Industries (TTI), has had strong growth in North America for years. A lot of this comes from its M18 and M12 battery setups, loved by pros\ [4].

For pro mechanics, Snap-on is a key choice. With prices from $50 to over $200 per tool, over 80% of U.S. mechanics pick Snap-on. Its mobile van sales make buying easy for pros[4].

Ryobi, also from TTI, aims at DIY fans and home people. With cordless drill sets priced from $60 to $100, Ryobi brings pro-style tools to those who love home work[4][3].

Store-only brands are also big. Husky (only at Home Depot), Kobalt (only at Lowe’s), and RIDGID cordless tools (made by TTI under Emerson’s name) give good choices specific to their stores[3].

Brand Features and Specialties

Brands like Milwaukee, DeWalt, and Snap-on are for pros who need tools that last under hard use every day. They price their cordless drills from $150 to $300, focusing on long battery life and tough use at work sites. Milwaukee’s M18 Fuel tools often get 4.7/5 at Home Depot, and DeWalt tools often get 4.5/5 or more on places like Amazon and Home Depot[4][3].

For DIYers, brands like Ryobi, Craftsman, and Black & Decker focus on low cost and easy use. Ryobi’s One+ tools, for example, get about 4.4/5 ratings at Home Depot, with people liking the shared battery setup. Craftsman tools, now about 4.3/5 at Lowe’s, are liked for their wide range and good warranty[3].

Store-only brands like Husky and Kobalt are known for good prices, strong warranties, and the plus of easy returns and swaps in store[1][3].

Cordless power tools are trending. Unified battery setups that fit many tools help keep customers and make things more flexible. Smart tools are also up and coming, with features like Bluetooth to watch battery levels, track use, and find lost tools via phone apps[3].

Warranties and help after buying really shape brand loyalty. Brands like Snap-on and Husky give lifetime warranties on many items, while others have long service plans and easy ways to get spare parts. For pros who use their tools every day, strong support often matters more than the first cost[1][3].

Next, we’ll look at how European brands do when it comes to new ideas and their focus on the market.

Tool Makers in Europe

Tool makers in Europe are known for their top skill and fine work, made for both pros and the DIY fans.

Well-Liked European Brands

Bosch, a big name from Germany, is top in the European realm with its two lines: the pro-level blue line and the user-friendly green line. This clear split helps the brand meet the needs of both pros and hobby crafters well.

Festool, seen as the "Apple of power tools", is praised for its top cut and dust care. Its smooth system fit makes it a pick among those who work with wood and do finish work.

Hilti, from Liechtenstein, is a key choice in the building field. Its tools, best for concrete work and making things fast, use a sell-direct plan that looks out for pro needs.

Metabo is all about tools for working with metal, doing great in heavy work spots where tough and top work is key.

Other top German brands like Flex and Mafell are clear too. Flex is known for its strong grinders and polishers, while Mafell makes tools for working with wood that are built for fine and sure work.

European hand tools are top-notch too. Knipex is known the world over for its pliers and special tools, while Facom (France), Bahco (Sweden), and Wera (Germany) are known for their feel-good designs and fine make.

These makers meet different buyer needs, giving traits meant just for the work of pros and hobby fans.

Key Markets and Niche Skills

European tool brands are tops in market split, with clear cuts in what they offer and how they price. Top brands like Festool, Hilti, and Mafell almost only make tools for pros. Their high-end traits, long warranties, and strong help say why they cost more.

In the pro world, Festool and Mafell are big in woodwork and making things, Metabo leads in working with metal and making things, and Hilti is a trusted name in building, a lot in working with concrete. Hand tool heads like Knipex and Facom are picked in electric and machine jobs for their sure and fine work.

For the DIY crowd, Bosch’s green line has top tools at fair prices, making pro-like work open to crafters. Both Bosch and Festool also mix in smart battery setups and high-end dust fix tech, while Fein stands out with its Starlock setup for multi-tools.

European names stress comfy designs, safety, and tool fit, bringing tools that meet the high needs of pros. While their goods often cost more, they give the sure work and top-grade that users want.

Not like many North American names that lean a lot on big-shop sellers, European brands tend to pick special sellers and sell direct. This way keeps up their top image and deep know-how.

North America vs Europe: Brand Comparison

The tool markets in North America and Europe show clear differences in customer reach, product focus, and pricing strategies. These variations stem from unique regional needs, shopping behaviors, and consumer expectations.

Availability and Distribution Differences

In North America, brands like DeWalt, Milwaukee, and Craftsman thrive on their widespread availability. Their tools are stocked in major big-box retailers like Home Depot and Lowe’s, alongside a strong online presence through Amazon and their official websites. This ensures that customers, whether professionals or hobbyists, can easily access their products.

European brands, on the other hand, often adopt a more selective distribution model. Companies like Bosch, Festool, and Knipex primarily sell through specialty stores and authorized dealers. Many also limit online sales to approved platforms to maintain control over pricing and service standards. While this approach ensures high-quality service, it can make these tools harder to find outside Europe. However, specialty importers are increasingly making European tools available online in North America.

Some brands, such as Bosch, operate in both markets but tailor their offerings to align with local preferences. Even so, product lines often vary between regions, reflecting the distinct needs of their respective audiences.

These contrasting distribution strategies influence product focus and pricing across the two regions.

Product Focus and Pricing Differences

North American brands tend to offer a wide range of tools designed to appeal to both DIYers and professionals. Their pricing reflects this broad approach, with entry-level tools starting as low as $10–$20, while professional-grade tools range from $50 to $300. This value-driven strategy caters to diverse customer segments.

European brands, by contrast, focus heavily on specialization. For example, Festool is highly regarded for its advanced dust collection systems in woodworking, while Knipex is known for precision hand tools. This emphasis on niche markets means European tools often carry a higher price tag, with entry-level options starting around €20–€40 and professional-grade tools frequently exceeding €150. For instance, a single wrench from Stahlwille can cost over $100. These higher prices are often justified by the use of premium materials, precision engineering, and robust warranty coverage.

Another notable difference is in measurement standards. North America relies on imperial units (inches, pounds), while Europe uses metric units (millimeters, kilograms). This can create compatibility issues for tools and equipment used across regions.

Regional Comparison Table

| Feature | North America | Europe |

|---|---|---|

| Top Brands | DeWalt, Milwaukee, Craftsman, Snap-on | Bosch, Festool, Knipex, Facom, Gedore |

| Retail Presence | Big-box stores and widespread online | Specialty shops and authorized dealers |

| Price Range | $10–$300 (broad range) | €20–€300+ (premium focus) |

| Product Focus | Broad appeal for DIY and professionals | Specialized, precision, and specialty trades |

| Measurement Units | Imperial (inches, pounds) | Metric (millimeters, kilograms) |

| Distribution | Mass market, high availability | Selective, controlled distribution |

| Warranty/Service | Extended warranties and accessible support | Robust locally; more limited in North America |

| Online Sales | Amazon, Home Depot, direct brand sites | Regional platforms, authorized dealers only |

This table highlights the distinct approaches taken by each region. North American brands prioritize accessibility and affordability, appealing to a broad audience. European brands, however, excel in specialized craftsmanship, often targeting niche markets with premium offerings. These differences explain why some brands dominate their home markets while facing challenges in international expansion, particularly with measurement standards and support services.

Managing Tools from Different Regions

When dealing with tools from various regions, it’s easy to run into unexpected hurdles. Differences in measurement systems (imperial vs. metric) and electrical standards (120V vs. 230V) can lead to tool incompatibilities and even safety risks. These issues highlight the need for a well-organized management system to keep everything running smoothly.

Cross-Regional Tool Organization Challenges

Managing tools across regions comes with its own set of complications. For instance, tools often have different names or model numbers depending on the market. Take Bosch, for example: what’s called a "combi drill" in Europe might be marketed as a "hammer drill" in North America, even though they’re essentially the same tool. Such inconsistencies can cause confusion when trying to find or replace equipment.

Cordless tools add another layer of complexity. Battery systems and charging standards vary widely between regions, often requiring adapters or converters to make them compatible. These differences extend to storage needs as well, as you’ll need to organize accessories and adapters specific to each region.

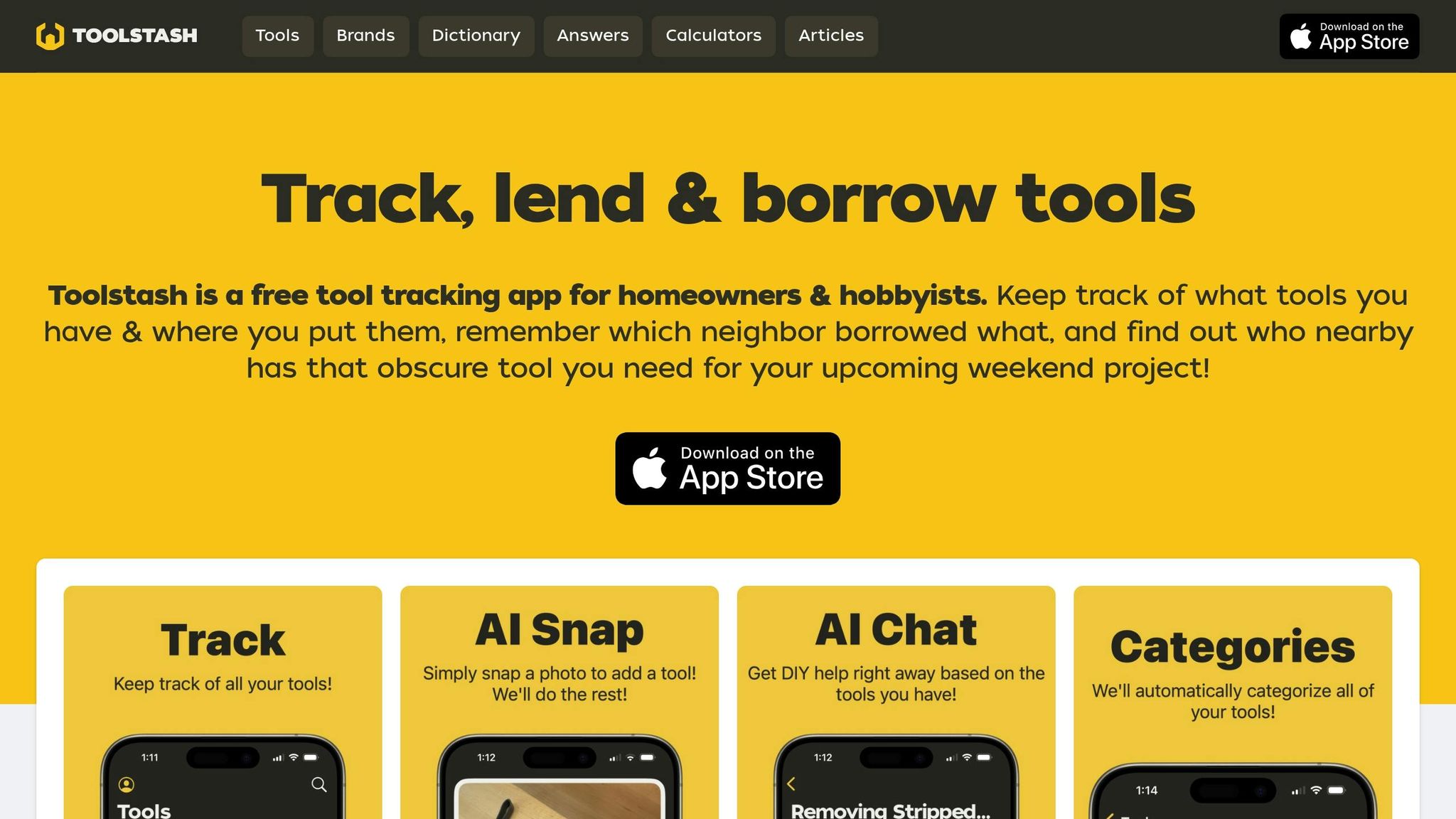

How Toolstash Simplifies Tool Organization

Toolstash is designed to tackle these regional challenges head-on. Its inventory tracking system supports both metric and imperial units, making it easy to log tool specifications without any guesswork. Whether you’re searching for a drill bit measured in inches or millimeters, Toolstash ensures you find the right match.

The platform’s AI-powered tool identification feature is particularly handy. By simply snapping a photo of a tool, Toolstash can recognize and categorize it - whether it’s a North American DeWalt drill or a European Festool sander - and automatically log the correct specifications and regional details into your inventory.

To make organization even easier, Toolstash offers smart categorization. You can group tools by region, measurement system, or voltage requirements. For example, creating categories like "Metric Hand Tools" or "120V Power Tools" helps you quickly locate compatible equipment while avoiding costly mistakes.

Detailed records are another standout feature. Toolstash allows you to log critical details for each tool, such as voltage requirements, plug types, and adapter needs. For example, you can note that a European power tool requires a "230V to 120V converter" or that it "uses metric chuck sizes only." These insights help ensure safe and effective tool usage.

For those navigating regional tool differences, Toolstash also provides DIY content with region-specific advice. Whether you’re deciding between buying an adapter or upgrading to a compatible tool, this guidance can save you time and money.

The platform even simplifies lending and borrowing management. With high-value tools like Knipex pliers or Festool sanders, Toolstash keeps track of who borrowed what and when, ensuring your tools are always accounted for.

Finally, Toolstash offers secure storage for your investment records, warranty details, and purchase receipts. This ensures you can easily access the documentation needed for servicing tools according to their specific regional requirements.

Summary

The tool market across North America and Europe reflects distinct regional traits that influence both the availability and specialization of products. This overview pulls together the key differences and challenges discussed earlier, offering insights for anyone looking to build a versatile tool collection or navigate international markets effectively.

Regional Brand Differences Overview

In North America, brands like DeWalt, Milwaukee, and Stanley Black & Decker dominate the scene with extensive product offerings and strong distribution networks. These companies cater primarily to construction, automotive, and DIY needs, focusing on durability and forward-thinking designs. For instance, Stanley Black & Decker holds a major share in the U.S. power tool market, which is valued at over $10 billion annually[4].

European brands, on the other hand, are known for their precision and specialization, often targeting professional trades and niche applications. Brands like Bosch, Festool, Wera, and Knipex have earned a global reputation for quality, with Bosch ranking among the top 10 power tool manufacturers worldwide by revenue[2]. Despite globalization, product lines and availability still vary due to local regulations and market preferences. European tools often come with higher price tags, reflecting their reputation for precision and engineering quality, while North American tools are frequently associated with innovation and cost-effectiveness. These regional differences underscore the challenges of managing tools across markets.

Benefits of Tool Management Platforms

Digital management platforms offer a practical solution to the complexities of navigating regional disparities. A centralized platform simplifies the process of organizing and managing tool collections that span different markets and standards.

With tools varying in specifications and regional requirements, centralized inventory management becomes essential. Platforms like Toolstash provide an all-in-one solution, helping users handle these challenges seamlessly. They ensure compatibility across regions and simplify the organization of diverse tool collections.

Beyond inventory, Toolstash also offers educational resources that help users bridge the gap between regional standards. From buying guides tailored to specific markets to maintenance tips and compatibility insights, these resources empower users to make informed decisions about their tool investments.

Secure tracking features add another layer of value, keeping warranty and purchase records organized and accessible. As tool collections grow increasingly international, platforms like Toolstash serve as vital connectors, helping users get the most out of their investments while avoiding compatibility issues.

FAQs

Why do European tool brands emphasize precision and specialization more than North American brands?

European tool brands are known for their precision and focus on specialized tools, shaped by their long-standing manufacturing traditions and specific market needs. These industries often emphasize tools tailored for niche applications, reflecting a deep-rooted commitment to craftsmanship and meticulous attention to detail. This approach is closely tied to smaller-scale production environments and a strong heritage of engineering expertise.

On the other hand, North American tool brands typically aim to serve broader markets by producing versatile, multi-purpose tools. This strategy aligns with the demands of large-scale construction projects and the thriving DIY culture in the U.S., where tools are expected to handle a variety of tasks effectively. Each approach highlights the distinct priorities and preferences of these regions.

What challenges might arise when using European tools in North America, and how can they be resolved?

When using tools originally designed for the European market in North America, you might run into a few common hurdles, such as power compatibility, differences in measurement systems, and access to replacement parts.

One key issue is power compatibility. European tools typically operate on 230V, while North America uses a 120V system. To use these tools safely and effectively, you may need a voltage converter or transformer.

Measurement units can also pose a challenge. European tools often rely on the metric system, whereas the U.S. primarily uses imperial measurements. This can complicate precision work, requiring users to either convert measurements or find compatible accessories that bridge the gap between the two systems.

Finally, replacement parts or accessories for European tools may not be readily available in North America. If you face this issue, specialized retailers or online platforms can often help you track down the parts you need to keep your tools in good working order.

What are the key differences in tool brand availability between North America and Europe, and how do these affect consumers?

Tool brands can differ quite a bit between North America and Europe, largely due to variations in how they’re distributed, what local customers need, and specific regional regulations. In North America, many brands prioritize partnerships with big retailers and online platforms for widespread availability. On the other hand, Europe often leans toward distribution through specialized dealers and smaller, local stores.

For buyers, this means some brands or specific product lines might only be found in one region. Additionally, tools may come with different features or pricing depending on where they’re sold. Being aware of these differences can help shoppers make smarter choices, whether they’re buying locally or considering an import.